It was a very interesting short week in the markets last week, capped by a press conference from President Trump on our relationship with China and ahead of a volatile weekend of protests related to the death of George Floyd. So far, the markets continue to shrug off all of this volatility.

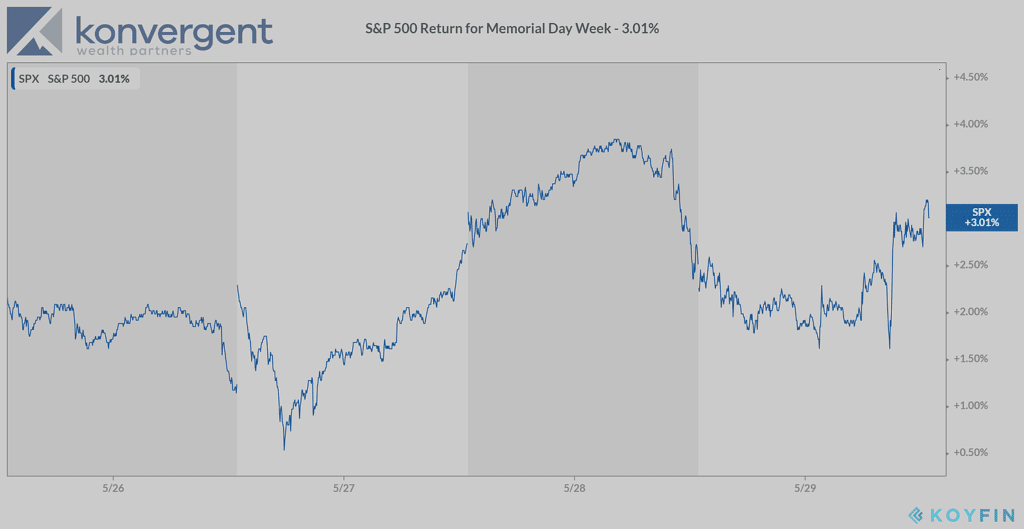

Last week, the market was up just over 3% with much of the positive moves related to hopes on the economy opening up. Friday had a few wild swings and had a large move from down around 1% to up around .5% on the day during President Trump’s press conference. Even though I felt the press conference was pretty hawkish, the market reacted positively to not directly threatening to unwind the recent trade deal.

The market move up seems to have no end in sight, despite how expensive this market is getting historically. We are now at about 24 on the forward P/E ratio with earnings expectations continuing to drop in conjunction with the rise in the market. While that is high, the small cap Russell 2000 index is about as expensive as it has ever been.

The market continues to rise to these historic pricing levels while economic data continues to be challenging. Unemployment data was released on Thursday last week showing over 2 million in new unemployment claims along with another 2 million of Pandemic Claims, according to the US Dept of Labor.

On a positive note, we saw ongoing claims fall last week to about 21 million showing that while we are still adding new claims, a decent amount went back to work last week. This does not include the Pandemic claims, however, so not as accurate to the full damage.

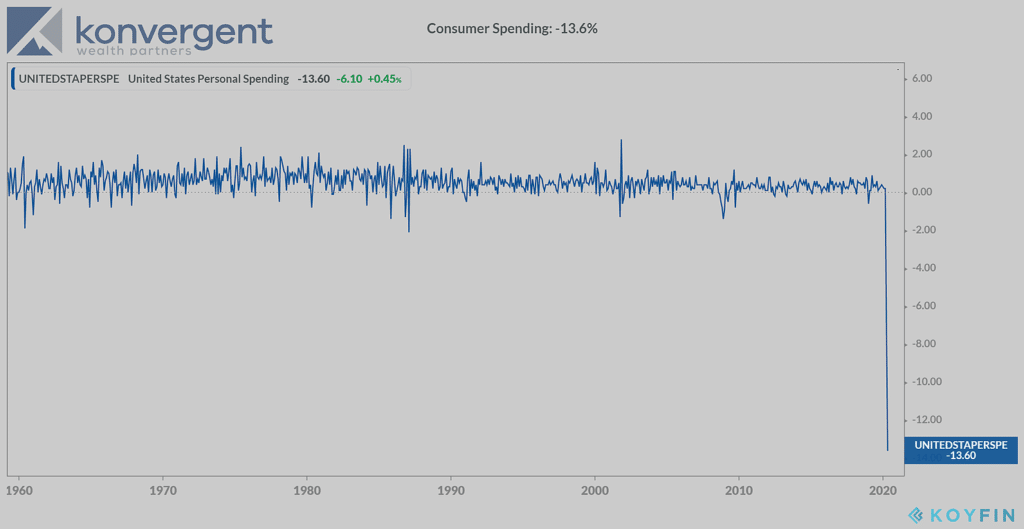

We also saw a huge drop in Consumer Spending that is historical in proportion while also seeing a huge jump in the savings rate in April. There is a lot of debate happening as to whether this is a one month phenomenon we are going to see a sharp uptick in spending and drop in savings soon or whether this will be sustained.

One interested fact when diving into the Bureau of Economic Activity, they include investing in the savings rate. According to data on bank transfers, for many income categories we saw a large increase in securities trading which could be driving some of the recent rise.

What does this all mean? This could mean, in the short term, a continued upside move in the markets which may lead us to adjust how we are managing portfolios if we believe this will be sustained. However, there is still overwhelming economic data that creates a lot of concern and uncertainty on where things will go from here. One thing we are waiting on is to see what happens when the Paycheck Protection Program funds run out in late June for most businesses that took them and what happens at the end of July when the current extra Pandemic Unemployment Benefits run out. We believe this still has a long way to go before we know how this will shake out and there will be more volatility to come.